This post came across my newsfeed yesterday and it was completely relatable. I don’t think people who have never been “broke broke” can truly understand it.

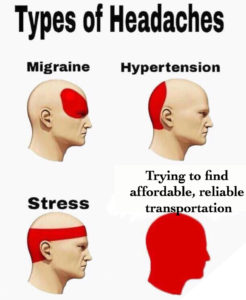

Being poor is expensive. Things cost more when you can’t afford them. Like vehicles. That’s been one of the biggest trials for us. When you are poor, there is no room for savings. Even if you can set aside $100 a week that is a year of savings to buy a used vehicle. When you have to get to work today, you have to compromise.

Several times we had to use rent money to buy a very cheap used vehicle hoping we could scrape up rent later. Robbing Peter to pay Paul right. It’s bad money management. It’s a dangerous game.

Once you purchase your very used cheap vehicle, you have an added cost of maintenance. You know that at any moment your vehicle can break down. You also know that Murphy’s law means it will happen on the way to work. Because being poor means living on the edge. Keeps things exciting.

Another option is going through a buy here pay here place. But you still have to scrape up $500-$1000 down. But you make payments. Fairly affordable but they rarely come with warranties so you are back in the situation to where you just know an expensive repair is just around the corner.

Buying used cars in Kentucky offers little protection. It’s buyer beware. One of the benefits (always find a bright side!) to owning high maintenance vehicles is that you learn how to fix them. The problem we are finding is that newer vehicles require special tools.

Ive recently re-evaluated our vehicle budget. One vehicle (not gas and insurance) we expect to spend around $6000 a year or $500 a month. As I blogged the other day, we are finally starting to get our heads above water, and we can afford that budget, but if you are a young person or anyone who is working min wager even just above $500 a month isn’t possible.

I was talking with a client the other day, she’s in a similar boat. She had come in just for a nail trim because she didn’t have enough for grooming. She’s on her second year with her buy here pay here vehicle and she’s just had to soak $1500 into it. $1500 she didn’t have. She did a payday loan (another wild expense) and used her rent to make the repairs. She can’t afford to maintain her vehicle but she’s already soaked over $6000 into it and can’t walk away. We live in a rural area, you need a car. Even in town there is no bus system.

With $500 a month a person in a good financial situation could afford a new car payment. They could have a reliable vehicle with no worries of unexpected repairs or having to be stranded without a vehicle. Having a vehicle break down is a huge headache. To make matters worse, Kentucky just decided to tax auto repair. This is going to impact lower income people.

Its difficult to get ahead when it’s costs so much more to be poor.

Loading Likes...